PNG tables lower budget deficit for 2023

News that matter in Papua New Guinea

PNG tables lower budget deficit for 2023

PORT MORESBY: The Papua New Guinea (PNG) Government has set the motion to heal the nation’s financial woes by tabling a deficit Budget 2023 that is K1 billion lower than last year's.

In reducing Budget 2023's deficit from K5.98 billion in 2022 to K4.98 billion, it also allocated K590 million for what it calls the “Household Assistance Package”.

Treasurer Ian

Ling-Stuckey said prices for some key items had gone up significantly and the

package was to help relieve cost-of-living pressures facing families.

PNG Cyber Monitor reproduces below a few key Budget 2023 reports published by The National:

Budget for all

November 30, 2022The

NationalMain Stories

THE Government has

allocated K590 million in the Budget 2023 for what it calls the ‘Household

Assistance Package’.

Treasurer Ian Ling-Stuckey said prices for some key items had gone up

significantly and the package was to help relieve cost-of-living pressures

facing families.

Presenting the money plan in Parliament yesterday, Ling-Stuckey said the

Government understood that the imported inflationary pressures were affecting

the price of cooking oil and rice and other essential household items, as well

as fuel costs.

The K590 million relief includes:

- TAX cuts of K63 per fortnight

for those earning more than K20,000 per year for 2023. This will be done

by temporarily lifting the tax-free threshold to K20,000 at a cost of K280

million;

- K150 MILLION will be provided

for reducing fuel prices. All excise taxes on fuels will be removed

through to June 30, 2023. This will keep petrol prices down by about 61t

per litre, and diesel prices down by 23t per litre; and,

- K160 MILLION is allocated for

removing school fee project costs in 2023. This is a

particularly-important measure to get assistance out to rural areas and

families.

“A family no longer has to pay the project fee of K220 for each of its children

attending secondary schools. Families will be saved K60 for each child

attending primary school, or K200 for each child attending vocational schools,”

Lin-Stuckey said.

For the income tax cuts, Ling-Stuckey added workers earning less than K769 per

fortnight, they will pay no income tax at all.

“This measure benefits those that are in the formal sector earning more than

double the minimum wage, some five per cent of PNG’s workforce,” he said.

He said the relief is provided despite inflation being expected to fall in 2023

to 5.7 per cent, significantly below PNG’s long-term average inflation rate of

6.8 per cent.

The inflation measure is an average measure of costs including housing costs

and whitegoods and furniture and electrical and sometimes does not fully

reflect the pressures being felt by households in their weekly grocery

shopping.

“The Government will continue monitoring these cost of living pressures on

families. There is a clear willingness to provide relief, but a government

committed to budget repair simply cannot afford to cover all of these

cost-of-living issues.

“What has already been done in 2022 and again in 2023, at a total cost of

K1,177 million (K1.2 billion) across two years, is already very substantial,”

he said.

Prime Minister James Marape on Monday said the Budget 2023 was the ‘people’s

budget’.

He said it was the first time for a government to develop a household assistance

scheme, to help address some of the cost-of-living pressures such as increased

prices for fuel, cooking oil, rice and fertiliser for farmers.

Meanwhile, Parliament Clerk Kala Aufa said debate on the budget would most

likely be on Friday.

“Tomorrow will be normal government business,” he said.

November 30,

2022The NationalMain Stories

“Now we’ve more or less decentralised most of the funding back to provinces and

districts to give more power back to them.”

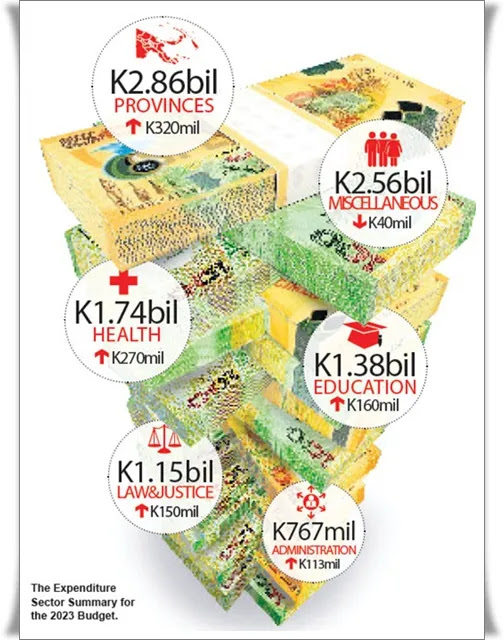

The provincial sector is set to benefit from the majority of the operating

budget, receiving K5 billion or 25 per cent of the budget component, an

increase in K800 million from Budget 2022.

“From where we sit as a national government working to tick off the main ticket

agendas, we also see the need to decentralise the budget to districts and

provinces, for them to be able to carry out some of the projects,” Paita said.

“While the Department of Works is working on Connect PNG, the districts are now

entrusted to build the district roads to connect back to the main trunk roads,

provincial roads and back to the Connect PNG programme so the alignment in the

budget has to be there,” he added.

Paita noted that K50 million worth of funding for the census under the

administration sector has been allocated for census preparation.

Funding has been allocated to the housing minister to cater for national

housing and affordable housing programmes to cater for the increase in

population and urban evictions.

“K6 million has been given to the land development programme. Land is a big

issue when it comes to development so that allocation under the Public

Investment Programme (PIP) for land development will assure any investor that

want to work with the Government that there is funding to free up land,” Paita

said.

“From last year, you’ll see a decrease in the administration component and

increase in provinces and other sectors, so we’re entrusting the departments to

work with us when we set those development agendas for our programmes in the

PIP budget.” Paita noted that most of the roads in the Connect PNG framework

have never been linked in the 47 years of independence, Gulf to Southern

Highlands highway and the Port Moresby to Alotau among them.

“Connect PNG is not just about roads; it’s about telecommunications, jetties,

districts in maritime provinces where it is difficult to access land markets

and so this is still one of the core priorities going forward,” he said.

“We’ve also increased funding in the education space, building new facilities

like a standalone university that will train doctors, nurses, medical imaging

and providing the specialised workforce.

As Port Moresby General Hospital (PMGH) is overcrowded, Paita said for the next

five years the Government planned on allocating funds to build a central

hospital with 395 beds that could take the pressure off PMGH so that it would

just be a specialist referral hospital.

He noted a significant increase of K150 million for an additional 5,000 police

officers to the law and order budget for next year and said the Government

would be making it one of its priorities to build its own offices.

Govt targets surplus budget by 2027

TREASURER Ian Ling-

Stuckey tabled a deficit budget of K4.9 billion for next year in Parliament

yesterday.

He said the money plan would deliver a billion-kina reduction in the size of

deficit, down from K5.9 billion this year.

Ling-Stuckey said the Government would ensure the figure kept falling until a

surplus budget was reached in 2027.

“This is all part of a 13-year plan to get our budget books back into order, to

stop building up debt,” he said.

Total expenditure for next year was an increased K24.5 billion and revenue

estimated at K19.5 billion.

State Enterprises Minister William Duma described the Budget 2023 as a

“balanced and realistic” money plan.

Bank taxes to put PNG

in top-two

November 30, 2022The

NationalMain Stories

Bank taxes to put PNG

in top-two

November 30, 2022The

NationalMain Stories

And Kina Bank chief executive officer Greg Pawson said the bank strongly

opposes any increase in corporate tax rate for the banking sector.

“Raising tax on banks to 45 per cent, from 30 per cent, will be detrimental (to

the banking and financial sector). We vehemently oppose any increase in rate

for the banking sector. And we are also disappointed with the lack of

consultation by the Treasurer (Ian-Ling Stuckey),” he added.

According to Tax Foundation (https://taxfoundation.org/publications/corporate-tax-rates-around-the-world/),

Comoros (Southern east Africa) has the highest tax in the world (50 per cent),

now followed by Papua New Guinea (PNG) at 45 per cent.

Puerto Rico (37.5 per cent) is third and Suriname (36 per cent) is fourth.

Barbados (5.5 per cent), Uzbekistan (7.5 per cent) and Turkmenistan (eight per

cent) are the lowest corporate rates in the world. Fifteen jurisdictions do not

impose corporate tax.

The worldwide average statutory corporate income tax rate, measured across 180

jurisdictions, is 23.54 per cent. When weighted by Gross Domestic Product

(GDP), the average statutory rate is 25.44 per cent.

Fleming said the increase in taxes would be a disincentive for potential new

investors.

“BSP understands that the Government will be repealing the Additional Company

Tax of K190 million per annum which applies only to BSP from 2023,” he added.

Fleming said the absence of competition in the banking sector had long been

seen as an important issue for Bank of PNG and the Government.

“Whilst the banking sector has been seen to be profitable in recent years, the

sector has absorbed many costs associated with delivery of banking services to

the people of PNG which includes inflation-related adjustments to operating

costs, exchange rate driven costs in license fees and other professional

services that can only be provided from offshore, and costs associated with

infrastructure services such as power and telecommunications.

“It is pleasing that the additional company tax act will be repealed. However,

the overall amount of tax paid by BSP will not change and the profits after

taxation that are available for distribution to all of our shareholders by way

of dividends will still be negatively impacted.

“Our shareholders such as Kumul Consolidated Holdings, Nambawan Super, Nasfund,

Teachers Savings and Loans, Credit Corporation and Petroleum Resources Kutubu

will continue to receive reduced dividends as a result of the higher tax rate,”

Fleming said.

Pawson said the unintended consequences of such a move would be detrimental for

the banking sector in PNG which was already structurally imbalanced.

Treasurer Ling-Stuckey, during the tabling of Budget 2023 in Parliament

yesterday, said the tax was expected to raise K240 million (for the Government)

to fund vital core services.

“We will consult with the banking industry in the first half of next year, and

consider if a different type of tax, such as an additional profits tax, may be

more appropriate from 2024 onwards, while still raising required revenues,” he

added.

Budget repair ongoing, says treasurer

PAPUA New Guinea

cannot be economically independent if it continues to rely on international

budget support, Treasurer Ian-Ling Stuckey says.

“We must, therefore, continue with our ongoing budget repair, economic reform

efforts and the strengthening of key institutions to achieve economic

independence by 2027.

“This will involve some tough choices in 2024. Budget 2023 is framed to fully

allocate extra resource revenues to increased investments, and further

household relief, rather than a Sovereign Wealth Fund or other savings

options,” he added.

Ling-Stuckey said that means 2024 expenditures were expected to be below the

estimated levels of 2023, with particularly larger cuts for the capital budget.

“Of course, this approach will be adapted, depending on developments in the

international and domestic economies over the next year.

“And we may push some expenditures to 2024, if deemed necessary, to manage

inflationary pressures or macro-economic stability. We will remain a responsive

and responsible Government,” he said.

Ling-Stuckey said the Government needed to continue micro-economic reform

efforts to increase jobs and grow incomes.

“Our businesses are clear that we must fix foreign exchange shortages, a

foolish home goal from 2014. Fixing this problem is why our key business reform

has focused on modernising our central bank.

“And we will continue to work with the International Monetary Fund and other

partners to return to a freely convertible Kina. We will implement the policies

and make the investments to get back to real non-resource growth of at least

five per cent per annum,” Ling-Stuckey said.

He said cabinet endorsement would be sought for a comprehensive Public Sector

Expenditure Review, “examining whether we are spending our monies in the best

possible ways”.

New revenue-raising measures introduced

Participants at the

tabling of the 2023 Budget.

Participants at the

tabling of the 2023 Budget.

SEVEN new measures to

raise revenue have been introduced in Budget 2023, Treasurer Ian Ling-Stuckey

says.

The said measures are:

- IMPLEMENTATION of the revised

dividend policy to increase revenue form state-owned enterprises with a

projected revenue of K1.06 billion next year;

- INTRODUCTION of the Non-Tax

Revenue Administration (NTRA) bill with a projected revenue of K550

million;

- APPLYING 45 per cent corporate

income tax on banks, which should bring about K50 million in revenue;

- INTRODUCTION of a one-off 493

per cent increase on the excise duties for anti-social drinks to

discourage consumption with an expected revenue of K30 million;

- INCREASE in progressive export

duty rates of unprocessed logs by 20 per cent to discourage export of

unprocessed logs and generate revenue to support the United Nations’

Biodiversity and Climate Trust Fund;

- INCREASE in personal income tax

free threshold to K20,000 for one year starting Jan 1; and,

- REMOVING excise duties on fuel

products (diesel, petrol and zoom) for six months starting Jan 1.

“The non-tax

administration bill replaces the PMMR (Public Money Management Regularisation

Act 2017) that the Supreme Court ruled as being in breach of constitutional

requirements.

“Implementation of the bill is expected to collect more than K550 million in

2023 and continue to increase non-tax revenue collections over time,”

Ling-Stuckey said.

Banks, shareholders lose: Official

THERE are some clear losers in Budget 2023,

such as the banking sector and its shareholders, Nambawan Super Ltd chief

financial officer David Kitchenoge says.

“The increase in Corporate Income Tax on the banking sector, from 30 per cent

to 45 per cent, will ensure shareholders will lose with falling prices when the

markets react to the news,” he said.

“If the increase is permanent, then it is a permanent loss to our members,” he

added.

“BSP made K1.5 billion profit last year so that increases the tax from K190

million to K225 million. Not only BSP, but it is now a tax on the banking

sector.”

Institute of National Affairs executive director Paul Barker said the banking

industry would be concerned with the tax.

The additional company tax only hit two dominant industry players, BSP and

Digicel.

“It is a one off opportunistic tax. Now they are trying to make it less crude

and say it will be across the board for all banks,” he added.

Economy to stabilise at

four per cent

November 30, 2022The

NationalMain Stories

Speaking during the Budget 2023 press lockup yesterday, Oaeke said that is 0.5

per cent lower than what was projected in this year’s Mid-Year Economic Fiscal

Outlook (MYEFO).

“We anticipate the growth to stabilise around there (four per cent)

particularly driven by sectors such as agriculture, forestry and the fisheries,”

Oaeke said.

“The domestic economy was estimated to grow by 4.6 per cent in 2022, down by

0.1 percentage points.

“This is mainly driven by weaker than expected performance in the Oil and Gas

and AFF sectors.

“In 2022, the Oil and Gas sector is estimated to grow modestly by 1.4 per cent

compared to the 2.7 per cent estimated at the 2022 MYEFO.

“Low growth in the sector was attributed to a 33.0 per cent decline in

Condensate production in 2022, although the shortfall is offset by higher LNG

production than its nameplate capacity of 8.3 million tonnes per year.”

Mining and Quarrying sector is estimated to grow strongly by 13.5 per cent in

2022, up from 12.9 per cent at 2022 MYEFO.

Increased gold production from Ok Tedi, Hidden Valley, and Kainantu together offset

the slight decline in Ok Tedi’s copper and Ramu Nickel’s cobalt productions.

“Overall, the resource sector is estimated to grow by 4.8 per cent, 0.9

percentage point lower than the 2022 MYEFO estimate.

“Growth in the non-resource sector in 2022 is estimated at 4.5 per cent, 0.1

and 1.2 percentage point higher than the 2022 MYEFO and 2022 Budget,

respectively.

“The improved growth outcome reflects increased economic activities in the

Business Liaison Sectors (BLS) of the economy, aided by stronger than expected

recovery in the private sector and increased election related spending.

“In 2023, the economy is expected to remain resilient at 4.0 per cent, 0.5

percentage point lower than 2022 MYEFO estimate.

“The downgrade was attributed to a significant decline in the Oil and Gas

sector (-7.2 per cent) as PNG LNG revised its LNG production down to its

nameplate capacity for 2023 and outer years,” Oaeke said.

Economist concerned about allocations

INSTITUTE of National

Affairs executive director Paul Barker says there are concerns around how the

Budget 2023 allocations will be managed and used by various government agencies

and arms of Government.

Commenting after its tabling in Parliament yesterday, he said it was quite an

uncertain budget “because we are in uncertain times with the global inflation

rates and the prices of all commodities.

“The Government is focusing on priority areas of health, law and order,

education and agriculture which is good but there are some concerns about some

of the mechanisms,” Barker said.

“Just putting money into these Government institution, but how’s that going to

be managed and spent?

“Some of these Government institutions are pretty unaccountable so again a real

priority.

“I don’t see it reflected in some of the budget allocations.

“It’s absolutely critical to strengthen one implementation like capital budget

implementation but particularly enhance the accountability of that expenditure.

“That applies to the recurrent budget and to the capital budget and that

includes at the district level because we know that from past audits a lot of

the district expenditure has been highly inflated, very much allocated on a

personal preference.

“We need to get those annual audits up to date because the PNG public needs to

know.”

Govt planning to hire external auditors for

checks, balances

THE Government is looking to hire external

auditing companies to perform checks and balances on Government departments,

Finance and Planning Minister Rainbo Paita says.

“When we’ve allocated funding in the previous years, we’ve had issues of

monitoring and auditing projects or being able to monitor the funding we give

to provincial and district departments,” he said.

Paita said the Government would be engaging international firms to audit,

monitor and evaluate projects so when funding was awarded to projects, there

were clear or tangible results.

“Sometimes there are discrepancies and we have issues with our own departments

trying to monitor and audit projects so we want to outsource that function to

international firms,” he said.

“We want to outsource that function to companies like KPMG, Deloitte, Price

Waterhouse Cooper (PWC), so that when you know that international firms will be

auditing your projects, you know that someone external is going to come after

you and look at your books whether you’re delivering on the programmes and

projects being funded.”

Paita acknowledged the Treasurer for increasing the Public Investment Programme

(PIP) budget, as last year there was K8.9 billion, with an increase now of 12

per cent to about K9.7 billion.

“The PIP budget is trying to unlock the potential we have in our country while

at the same time not forgetting key priority projects such as health,

education, law and order and other components that are being funded,” he said.

“We don’t want to blame former governments but as a government we want to be

able to see the landmarks in 2025 when we turn 50,” he added.

Institute of National Affairs executive director Paul Barker, in response,

questioned why there was no significant increase to the auditor-general

instead, and pointed out that the Government was still behind in implementing

the current development budget.

Do not interfere:

Official

November 30, 2022The

NationalMain Stories

“The budget itself is okay but it is the implementation that is of concern,” he

said when commenting on the tabling of Budget 2023.

“The implementation is weakened by political interference.

“It is noble, the things that the Government is planning to do (in the budget).

“They have very good initiatives but, in my opinion, they have crossed over

from being political authority into public administration which just weakens

the system.

“The secretaries are not free by virtue of them being mandated as secretaries.

“They (should) not (be) subjected to political interference.

“These so called unsolicited projects, we did not have those unsolicited

projects before.

“The new ministers, through their own processes, come up with projects in their

favour.”

Kambori said they should go through a planning process for over five years.

“The treasury and planning budget review process is a cycle since

Independence,” he said.

“The budget review process, the planning review process, the public investment

programme and the quarterly budget review process.

“Minister Rainbo Paita said they are not going to absorb monitoring and

evaluation but that is a function of the Government.

“You do not give it to the private sector. “Outsourcing will cost us money per

unit labour,” Kambori added.

Project fees on way out, household scheme in

ABOUT K160 million has

been allocated towards removing school project fees in the next academic year,

Treasurer Ian Ling-Stuckey says.

This was part of the K590 million cost of living relief provided in the K24.5

billion Budget 2023 handed down in Parliament yesterday by Ling-Stuckey.

“This (K160 million) is a particularly important measure to get assistance out

to rural areas and families, many of whom do not have a car or a job earning

more than K20,000 per annum,” he said.

Prime Minister James Marape noted that it was the first time for a government

to develop a household assistance scheme to help address some of the

cost-of-living pressures such as increased prices for fuel, cooking oil, rice

and fertilisers for farmers.

Govt tables general expenditure bill, plans to

mobilise non-tax revenue

THE Government has

tabled the General Public Service Expenditure 2023 bill in Parliament

yesterday.

The appropriation bill details expenditure items of government from its list of

priorities with funding from the consolidated revenue.

The government money plan was part of the seven enabling bills presented by the

treasurer.

These include; l GENERAL Public Services Expenditure 2023;

- JUDICIARY Services bill 2023;

- NATIONAL parliament 2023

(appropriation);

- INCOME Tax (Amendment) bill;

- CUSTOMS Tariff (Amendment)

bill;

- EXCISE Tariff (Amendment) bill;

- INCOME Tax (Salary and Wages

(Amendment) bill; and the,

- INCOME Tax, Dividend

(withholding) Tax and Interest (withholding) Tax Rates (Amendment) bill.

Treasury Minister Ian Ling-Stuckey also presented the Non-Tax Revenue

Bill.

“The introduction of the non-tax Revenue bill

is to continue the good work of mobilising non-tax revenue and then Public

Money Management Regularisation (PMMR) Act,” he said.

He said the government introduced the PMMR Act 2017, in the 2018 budget and its

purpose was to bring all non-tax revenue collection into a consolidated revenue

fund to support the budget and allow all government agencies to be funded

through the normal budget process.

“However in May 2020, the Supreme Court declared that the PMMR Act was

unconstitutional,” he said.

Its implementation he said was nullified.

“And as a result, the non-tax revenue were not remitted to the consolidated

revenue funds but were withheld by State agencies and statutory bodies,” he

said.

“This significantly reduced the government’s revenue collections.

“The government in close consultation with relevant agencies has developed the

NTR administration bill.

“The bill will rectify the tactical errors and defects of the PMMR Act.”

Ling-Stuckey further added that the implementation of the bill was expected to

collect more than K550 million in 2023 and continue to increase the non-tax

revenue collection overtime.

K1.15bil for law, justice

November 30,

2022The NationalMain Stories

Treasurer Ian Ling-Stuckey said that the sector had received an increase of

K150 million compared to last year’s allocation, where it was allocated K1

billion.

Police received the biggest cut in the sector’s allocation with K547 million.

Police Commissioner David Manning could not be reached for comment but his

office said he would make an official statement after the budget was debated

and passed.

Treasurer Ling-Stuckey said in his budget speech that he was delighted to see

advertisements in the newspapers for a further 500 recruits and 60 extra

officer positions.

“We have committed ongoing funding to the police, to continue this level of

recruitment. And we will lift the size of the police force from 5,000 this year

to over 7,000 by 2026,” he said.

The Papua New Guinea Defence Force received the second largest allocation with

K348.5 million and the Judiciary received the third largest cut in the sector’s

allocation with K272 million.

Ling-Stuckey said that the Government was delivering a 50 per cent increase in

funding for the judiciary, from K154 million last year to K272 million in 2023,

before a further increase to K310 million in 2024.

The Department of Justice and Attorney-General was allocated K228 million and

the Correctional Services (CS) was allocated K174 million.

CS commissioner Stephen Pokanis said he was pleased with the allocation.

The Magisterial Services received K91 million, the Ombudsman Commission was

allocated K32 million, the Office of the Public Prosecutor K18 million, the

National Intelligence Office was allocated K17 million and the Office of the

Public Solicitor was allocated K16 million.

The Legal Training Institute and the Constitutional and Law Reform Commission

got K13 million each.

However, the much talked about Independent Commission Against Corruption

received an allocation of only K10 million.

Comments

Post a Comment