Tax cuts for all in Papua New Guinea

News that matter in Papua New Guinea

Tax cuts for all in Papua New Guinea

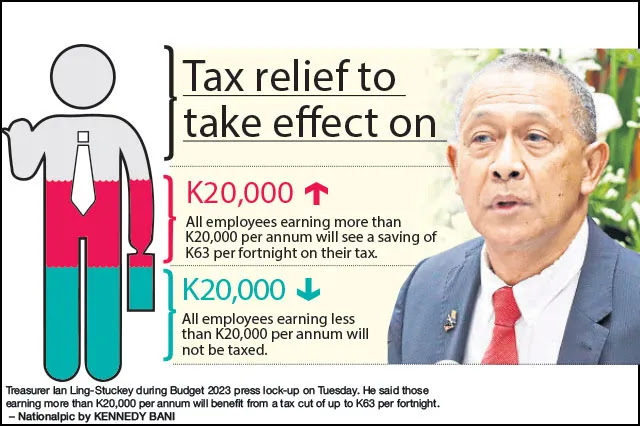

PORT MORESBY: All workers earning more than K20,000 per annum will get a K63 fortnight cut in personal income tax under Budget 2023’s K590 million relief package.

Treasurer Ian

Ling-Stuckey on Tuesday (Nov 29, 2022) said the tax-cut and tax-free threshold on

those earning less than K20,000 will come into effect on Jan 1, 2023.

The existing temporary

threshold is K17,500, increased from K12,500 on June 1.

“This is a very serious

increase in take-home pay for workers. We will do this by temporarily lifting

the tax-free threshold to K20,000 at a cost of K280 million,” he added.

The news break for workers was reported by The National:

Take-home pay to rise

December 1, 2022The

NationalMain Stories

ALL employees earning more K20,000 per annum

will see a saving of K63 on their tax as a result of the Government’s K590

million relief package in Budget 2023.

Treasurer Ian Ling-Stuckey on Tuesday said the tax-cut and tax-free threshold

on those earning less than K20,000 will come into effect on Jan 1.

The existing temporary threshold is K17,500, increased from K12,500 on June 1

this year.

“This (is) a very serious increase in take-home pay for workers.”

“We will do this by temporarily lifting the tax-free threshold to K20,000 at a

cost of K280 million.”

This means, those earning less than K20,000 will not be paying any tax.

The Government also announced excise duties on fuel and the removing of school

fee project costs in 2023.

KPMG, a global firm that provides audit, tax and advisory services, said

measures such as the employee tax threshold and the excise duties on petrol,

diesel and fuel, were aimed at easing the cost-of-living burden for

individuals.

“This measure is expected to reduce Government revenue by K280 million,” KPMG

said in its Budget 2023 analysis yesterday.

Deloitte, an accounting and auditing firm, noted that the tax-free threshold is

legislated as temporary, being only for 2023.

“This new measure represents an increase of K63 in take home pay per fortnight

over the equivalent period in 2021. This measure is expected to reduce

Government revenue by K280 million.”

Deloitte added that employment rates are on the rise after a decline during the

Coronavirus pandemic.

“For the year ending June 30, 2022, employment growth stood at 7.4 per cent per

Bank of PNG Statistics.

“The minimum wage, however, has not increased since the last determination in

July 2016 and a review into how minimum wages is established is underway.”

Meanwhile, Deputy Prime Minister John Rosso, last month, speaking in his

capacity as Labour minister said 70 per cent of employers in the country are

paying their workers less than the minimum wage rate of K3.50 an hour.

He said there was no reason to ask for an increased rate when some had not been

following the approved rate.

Comments

Post a Comment